Creating the project budget template shouldn’t be geared towards imposing limits on your investment; instead, it should be about managing the expenditure in a manner that makes it both feasible and exciting for your stakeholders. In other words, the project budget is an instrument that helps you direct your spending, to avoid ending up wondering where your finances have gone.

However, many of us still shudder at the thought of sitting down and writing a budget proposal. There’re enough variables involved to make your head spin and finding your footing feels nearly impossible. Let’s try to change this negative mindset with a quick rundown of the basics and introduce you to our simple project budget template in the form of a budget timeline. It’s the first step towards making your budgeting activity a lot easier.

What is a project budget template?

Project budgets are by no means fixed documents. You’ll definitely need to ready the sample of budget proposal for project kickoff meetings, sure! Still, they are meant to be adaptive templates and will require multiple calibrations throughout the enterprise’s lifecycle. But what should the project budget tracking template include? Here’s a quick overview of the categories of project deliverable costs:

- Labor expenses

- Material procurement expenses

- Operating costs

How does a detailed budget proposal example of costs look?

A more comprehensive breakdown of your cost tracking spreadsheet could include:

-

Direct costs - These are expenses that are directly related to the project and can be easily traced to specific project activities.

Examples:

-

Human resource expenditures like salary rates;

-

Materials and supplies used in the project;

-

Equipment, tools, software or materials-related spendings, when the tools or software is purchased or developed specifically for the project;

-

Travel expenses, when the project spans multiple locations;

-

Costs associated with freelancers, subcontractors or consultants hired for the project;

-

Specific employee/external contractors training programs needed for the project;

-

Research expenditures such as studies, surveys to support the value or feasibility of the undertaking. (If the research is conducted as part of a larger project, this cost may also be allocated as an indirect or overhead cost.)

-

Indirect costs - These are expenses that are not directly tied to specific project activities, but are necessary for the project to be completed.

Examples:

-

Rent and utilities for the project workspace;

-

Insurance and taxes;

-

Accounting and legal fees;

-

Training and development programs, such as workshops or conferences, for employees;

-

Project management software or other tools that are used for multiple projects.

-

Overhead costs - These are expenses needed for the organization as a whole, and are not directly tied to any specific project. They are typically allocated to individual projects based on a predetermined formula.

Examples:

-

Rent and utilities for the entire organization;

-

Salaries and benefits for the administrative staff;

-

Office supplies and equipment used throughout the organization.

-

Contingency funds - This represents an amount of money set aside to cover unpredicted expenses that may arise during the course of the project. The contingency fund is typically a percentage of the total project budget, and is meant to improve flexibility and prevent budget overruns.

Examples:

-

Unforeseen travel costs, additional materials or supplies;

-

Labor costs due to changes in the project scope or requirements or other unforeseen issues that might arise;

-

Unplanned equipment or material costs;

-

Delays or setbacks that require additional work or resources;

-

Unforeseen expenses related to subcontractors or consultants.

If you want to go into more detail, your cost tracking spreadsheet could include further breakdown of items. For example:

-

Item description - A brief description of each item or expense can be helpful in providing context and understanding what the expense was for.

-

Quantity - Record the quantity of each item or expense needed for the project.

-

Unit cost - Record the cost per unit of each item or expense.

-

Subtotal - This column can help you calculate the subtotal for each item or expense by multiplying the quantity and unit cost.

-

Profit margin - This column can help you calculate the profit margin for the project by adding a percentage of profit to the total cost.

-

Total project cost - A total project cost column can help you calculate the total cost of the project by adding the total cost, contingency, overhead, and profit margin.

-

Notes - You can use this column to add any additional notes or comments about the expense.

-

Graphs and charts - Create graphs and charts to visually represent the project budget, illustrating the breakdown of expenses by category, the percentage of the total budget allocated to each category, the expenses spread over time, and other relevant information.

Why do you need a project management budget template?

One obvious answer to this question is that without funds, the project can’t get off the ground in the first place. The budget represents the beating heart of any enterprise and, like any heart, its role is to direct and allocate the financial lifeblood exactly where it’s needed.

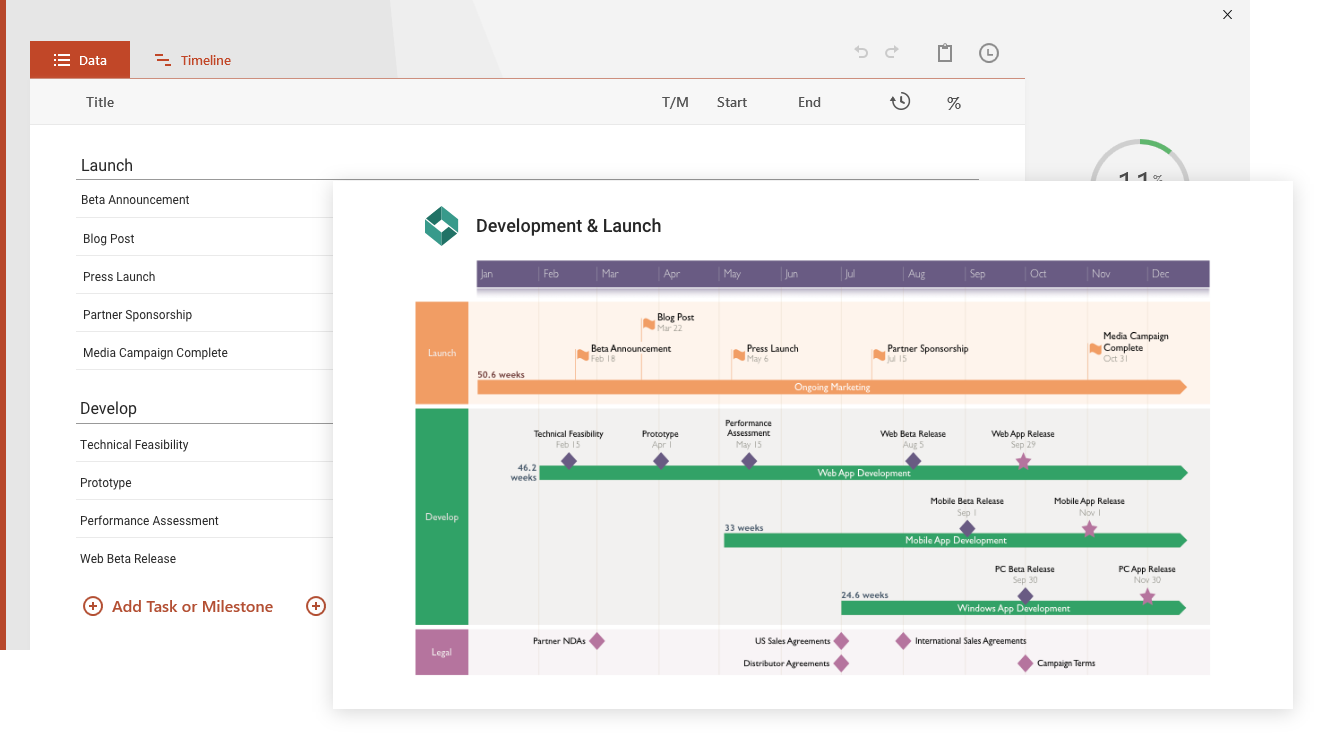

Plus, before your stakeholders and management can approve the project, they will need to evaluate the budget proposal example, in terms of investment value and how the money is spent. On a side note, we believe there’s no better way to create an enticing narrative than the budget timeline, which not only breaks down the costs for each project phase but also shows when finances are needed.

Finally, it’s worth remembering that the budget timeline template is essentially a profitability benchmark. To put it simply, it allows project managers to use it as a baseline in measuring the estimated performance of the project throughout all its phases against the actual costs.

Using the project budget timeline template

We created this project budget template using Office Timeline, a powerful and easy to use add-in for PowerPoint and you can download it free of charge along with other fully customizable timeline templates. Download the tool’s free 14-day trial to test it out and learn how to create timelines that will awe your stakeholders and guarantee an approved project budget every single time.

Frequently asked questions about project budget

Let’s go through some of the most frequently asked questions about creating your project budget.

How do you write a budget for a project? What are the steps of the budgeting process?

A project budget is like a guide that shows how much money is required, what it will be spent on and when it will be used. Writing a budget for a project involves mainly identifying all of the necessary expenses associated with the project and estimating the total costs associated with all tasks, activities, and milestones that need completion. Including a timeline in your project budget is always a good idea, as this helps estimating the spent in relationship with the progress of the project.

Preliminary step: Defining project scope and setting project objectives should be completed before starting to create the project budget, as they are important in identifying project boundaries and help determine the resources required and associated costs.

Now we’re ready to see what steps could be followed when writing a project budget. These are:

-

Break deliverables into smaller tasks. To do this, make a list of all the items that need to be delivered within the project scope, and then break them down into smaller dependent tasks. Thus, you can ensure that your budget accounts for all the concealed expenses associated with your project.

-

Make a list of resources. This can include human resources such as team members, contractors, and vendors, as well as equipment, software, and other materials.

-

Estimate the cost of each activity. With the list of tasks and resources in hand, estimate the cost of each activity. This can include things like salaries, equipment rentals, and materials costs. Be as accurate as possible in your estimates, and consider using historical data or industry benchmarks to inform your estimates.

-

Identify contingencies. No project goes exactly according to plan, so it's important to identify potential risks and plan for contingencies. This can include costs associated with delays, changes in scope, or other unexpected events.

-

Add up all the estimated costs and the contingency to get the total project budget. For a complete picture of how much you’ll need for the project, once you have estimated the cost of each activity and identified any contingencies, add up all the costs.

-

Monitor and analyze. Once the project is underway, you’ll need to monitor progress, review actual costs against estimated costs, and analyze any variances to make sure the project stays in line with the budget.

What is included in a project budget?

A project budget typically includes the estimated expenses associated with completing a project, overhead costs and contingencies. For example:

-

Labor costs - These are the costs associated with paying employees, contractors, or consultants who work on the project. This may include salaries, hourly wages, benefits, and other compensation.

-

Equipment, materials and supplies - This includes any tools, materials or supplies needed for the project, such as office supplies, equipment, raw materials, or software.

-

Sales, marketing and advertising - If the project requires marketing or advertising, the budget should include these expenses as well.

-

Overhead costs - This includes indirect costs associated with the project, such as rent, utilities, and administrative expenses.

-

Contingencies and miscellanea - A contingency fund is a reserve of funds set aside to cover unexpected expenses or emergencies that may arise during the project.

-

Taxes - Last but not least, don’t forget about the taxes. The budget should also include any taxes or fees associated with the project, such as sales tax or import/export fees.

What are three examples of common budgeting methods?

Budgeting is a financial management tool that helps individuals and organizations plan and control their income and expenses. There are various budgeting methods that can be used, depending on financial goals, size, and complexity of operations. The selection of a budgeting method can be a combination of several methods.

Here are some of the most popular budgeting methods used by companies:

-

Incremental budgeting - This method involves making incremental changes or adjustments to the previous budget to account for expected changes in the business environment, such as inflation or changes in sales volume.

-

Activity-based budgeting - In this method, a project budget is created based on the specific activities required to complete the project. Each activity is assigned a cost, and the budget is then used to track actual expenses for each activity.

-

Value proposal budgeting (aka priority-based) - In this method, a project budget is created based on the expected value that the project will generate for the company. This can include factors such as increased revenue, cost savings, or improved customer satisfaction. The budget is then used to track the actual value generated by the project, rather than just the costs incurred. This method aims to to reduce over-spending by assessing expenses and determining if their benefit outweighs their cost.

What are three examples of budgeting methods used by individuals?

Individuals use budgeting methods to manage their personal finances. Budgeting can help track income and expenses, and prioritize spending. Popular budgeting methods for individuals include:

-

50/30/20 budgeting - With this method, you allocate 50% of your income to essential expenses like rent and bills, 30% to discretionary expenses like entertainment and dining out, and 20% to savings and debt repayment.

-

Envelope budgeting - This method involves allocating cash into different envelopes for various expenses, such as groceries, entertainment, and transportation, and using only the money available in each envelope for that expense category.

-

Incremental budgeting - The traditional or incremental budgeting method involves starting with a baseline budget and making small adjustments over time based on changes in income and expenses.

What is one way to prepare for building a project budget?

To budget a project successfully, the project manager must have clarity on project scope, resource availability, and risks. Good control of the project plan is also needed to fix deviations quickly for minimal impact on the final budget.

One way to prepare for building a project budget is to develop a detailed project plan that includes all the tasks, activities, and resources required to complete the project. This can help identifying the costs associated with each task or activity, such as labor, materials, and equipment. By having a clear understanding of the project scope and requirements and creating a timeline, it becomes easier to estimate the project costs accurately, and develop a realistic and effective budget.

What do you see as the most difficult part of budgeting for a project and why?

One of the most difficult parts of budgeting for a project is accurately estimating the cost of each project component. As you plan your project, you may find that this part can really be challenging, and here is why:

-

Accurately estimating the cost of each component, including the resources and materials required for each task, can often prove challenging because of possible unforeseen variables or unexpected changes that can affect the cost.

-

Additionally, there may be uncertainties in the availability and cost of resources, such as labor and materials, which can make cost estimation even more difficult.

Some of the measures to overcome these challenges can be conducting a thorough research, consulting with experts, and creating a realistic contingency plan to account for unexpected changes or cost overruns.

What are the three types of budget estimates that occur during the project life cycle?

The three types of budget estimates typically developed during a project’s life cycle are:

-

Rough Order of Magnitude (ROM) estimate. This is an initial, high-level, rough estimate based on expert judgment, historical data, or similar projects.

Created when? It is created during project initiation, in the early stages of a project when the requirements are not yet fully defined.

Used to: determine the feasibility of the project and provide a general idea of the project’s cost.

-

Detailed project budget estimate. This is a more detailed estimate, that includes a breakdown of costs for each project component.

Created when? This estimate is developed during the planning phase, once the project scope and requirements are well-understood.

Used to: set project budgets and allocate resources, and identify potential cost overruns.

-

Revised estimate (or Updated estimate). This type of estimate is used to predict the final cost of the project based on actual costs to date and any anticipated changes to the project scope, schedule, or budget.

Created when? This estimate is created during the monitoring and controlling phase of the project life cycle.

Used to: identify potential cost overruns and ensure that the project is completed within the approved budget.

What should I include in my budget binder?

A budget binder is an organizational tool that helps individuals or households keep track and stay on top of their finances. It typically consists of a physical binder that contains various sections and sheets for recording financial information, such as income, expenses, savings goals, and debt.

Its contents can vary depending on individual needs. For example, it can include:

-

Budgeting sheet with expense log. This would be a basic sheet to help track your income and expenses and create a budget plan for each month. The expense log would document all daily expenses.

-

Bill tracker and receipts organizer. A section that helps track monthly bills, due dates, and payment status with a section to keep track of receipts.

-

Savings and debt tracker. Helps see the savings’ status and stay on top of debt, monitoring the payment status and outstanding balances.

-

Financial goals sheet. A section to document short-term and long-term financial goals.

Keeping all your financial information in one place makes it easy to refer back to the budget binder and identify areas where you can adjust spending and saving habits.

How do you present a budget?

There can be various ways to present a budget, depending on the purpose, audience, and format required. The specific format and level of detail may vary depending on the audience and purpose of the presentation. However, here are some general steps to consider when presenting a budget:

-

Start with an executive summary. This should be a brief overview of the budget that highlights the key numbers and major categories of expenses. It should give the audience a quick understanding of what the budget is for and how much money is involved.

-

Provide a detailed breakdown of expenses. Depending on the audience and purpose, you may need to present a detailed breakdown of expenses by category or by project task. This can help stakeholders understand where the money is being spent and identify areas where cost savings may be possible.

-

Explain assumptions and variables. The assumptions and variables that went into creating the budget need to be very clear to your audience. You can include here things like inflation rates, variations in labor costs, or unexpected expenses that may arise during the project.

-

Use visuals. Charts, graphs, and other visual aids can be very effective in helping to present the budget in a clear and concise way and can make the presentation more engaging and informative. For example, a swimlanes timeline graph can be used to show how different departments or functions are contributing to the budget over time. This can be useful for highlighting areas where costs or revenue are out of line with expectations.

Finally, be prepared to answer questions and address concerns from stakeholders. They may have questions about specific expenses or want more information about how the budget was developed. Be prepared to provide clear and detailed answers to any aspect of your budget presentation.

How do you prepare an annual budget report?

Preparing an annual budget report can vary depending on the specific requirements and the level of complexity of the report. However, here are some general steps that can be a good start when preparing an annual budget report:

-

Gather financial data

Collect relevant financial data from various sources, such as bank statements, income statements, and expense reports, for the period covered by the report.

-

Review expenses and revenue

Analyze the expenses and determine which expenses are essential and which can be reduced or eliminated. Analyze the revenue sources and determine which sources are most profitable and which ones need improvement.

-

Create and review the budget

Based on the analysis of expenses and revenue, create a budget for the upcoming period. Keep in mind the current state of things in the company and its financial objectives. Once the budget has been created, review it carefully to ensure it is complete and accurate.

-

Present the report

Present the budget report to the relevant stakeholders, such as management, stakeholders, and investors. Using a visual aid will help to explain easier and in a clear manner the key highlights and any areas of concern.

In the process of preparing an annual budget report you’ll need a thorough understanding of the financial data, as well as strong analytical and presentation skills. To make the presentation part easier, we suggest using Office Timeline's PowerPoint add-in, which can help automate the creation of your reports, provide you with ready-made templates and solutions for easy report creation, and assist you in sharing your ideas through a clear, memorable, and impressive presentation. Try Office Timeline for free and enjoy the full benefits.